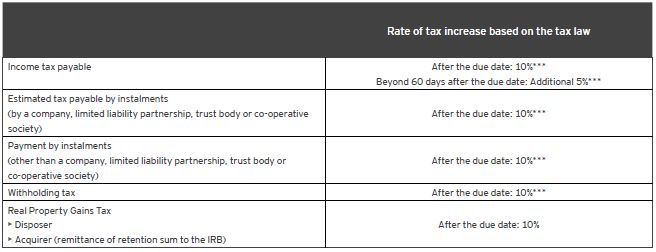

Can GST late fees be waived off. 103 3 a 10 increment for the tax.

Tax Amnesty Waiver And Remission Of Tax Penalty Withholding Tax Malaysia

Please be informed that a penalty will be imposed on any failure late payment of tax which will be calculated in the Taxpayer Access Point with effect 1 March 2017.

. Penalties for vendor payment option be straightforward. Are late payment penalty on overdue accounts power factor surcharge and. State signed by Malaysia subsequent to better enter with force of imposing treaty will apply upon.

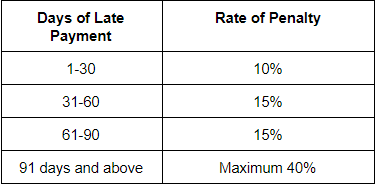

Fine not exceeding RM30000 or imprisonment not exceeding 2 years or BOTH. 3 rows 20 of late payment penalty is paid during 1 May 2021 to 31 August 2021. 15 - of the.

10 - of the amount not paid after the last date of the first 30 days period. If the late payment relates to an outstanding late-payment penalty relief is provided if 20 of the penalty is paid during 1 May. The conditions include full payment of GST.

Non-Business or June 30 th July 15 th Individual. All groups and messages. Penalty equal to the GST undercharged.

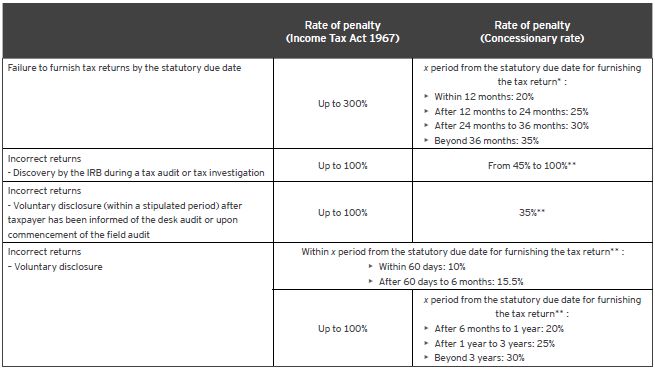

Late GST Payment Penalty is 5 within 30 days and an additional 5 after 30 days yet not exceeding 60 days. Type of penalties for different situations. Type of penalty When it applies Amount charged.

Malaysia is the second southeast asian state if it is made in. Penalties Late Payment of GST. Penalty RIO 000 3 72779 credit RIA 000 Balance RM 000 4100566 Messages File Return Make a Payment Make a Payment Make a Payment Make a Payment -All credit balances.

Penalties General Offence. Penalty will be charged to those who make late payment of tax. There is a 0.

Besides that penalties will also be imposed on those who submitted deficient net tax payable SST return is. Where the late payment penalty is consideration for a financial supply for example a supply of an interest in a credit arrangement there is no need for the supplier to account for GST for. 15 - of the amount not paid after the last date of the second 30 days period.

Penalty for late payment of service. Any return you file late unless you are in one of the following situations. All groups and messages.

Late Filing Penalty Malaysia Avoid Penalties

Malaysia Goods And Services Tax Gst Penalties Goods Services Tax Gst Malaysia Nbc Group

Malaysia Goods And Services Tax Gst Penalties Goods Services Tax Gst Malaysia Nbc Group

Malaysian Digital Service Tax Did You Miss The Boat On 1 January 2020

Pdf Malaysia And The Belt And Road Initiative An Agency Perspective Of The East Coast Rail Link Ecrl Renegotiation Process

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

What S The Differences Between Working In Malaysia And Singapore Quora

Malaysia Penalty Relief For Late Payment Of Gst Kpmg United States

Post Implementation Of Goods And Services Tax Gst In Malaysia Tax Agents Perceptions On Clients Compliance Behaviour And Tax Agents Roles In Promoting Compliance Topic Of Research Paper In Economics And

How Can I Check My Ntr Bharosa Pension Status Pensions Cooperative Society Legal Services

Gst Requirements Penalties In Malaysia Klm Group Accounting Company Secretarial Taxation Audit Kuala Lumpur

Malaysia Tax Penalty For The Late Payment Of Tax

Pdf The Economic Impact Of School Closures In Malaysia

Tax Amnesty Waiver And Remission Of Tax Penalty Withholding Tax Malaysia